The sarbanes-oxley act select all that apply – The Sarbanes-Oxley Act, enacted in 2002, revolutionized corporate governance in the United States. This legislation aimed to restore investor confidence and prevent corporate fraud, shaping the landscape of corporate behavior and regulation.

In this comprehensive guide, we delve into the background, key provisions, impact, criticisms, and future implications of the Sarbanes-Oxley Act, providing a thorough understanding of its significance and ongoing relevance.

Background and History of the Sarbanes-Oxley Act

The Sarbanes-Oxley Act of 2002 (SOX) emerged as a response to the string of corporate scandals and financial irregularities that plagued the early 2000s, particularly the collapse of Enron and WorldCom.

Key individuals involved in the Act’s development included Senator Paul Sarbanes and Representative Michael Oxley, who co-sponsored the legislation. The Act drew heavily from the recommendations of the Treadway Commission, a panel appointed by the American Institute of Certified Public Accountants (AICPA) to investigate corporate governance failures.

The timeline of major milestones in the Act’s history includes its passage by Congress on July 30, 2002, and signing into law by President George W. Bush on July 30, 2002.

Key Provisions of the Sarbanes-Oxley Act

Section 302: Corporate Responsibility for Financial Reports

Requires CEOs and CFOs to certify the accuracy and completeness of financial statements.

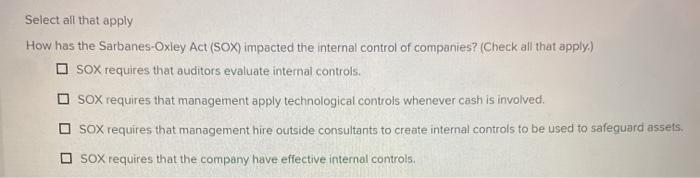

Section 404: Internal Control over Financial Reporting

Mandates companies to establish and maintain an adequate internal control system for financial reporting.

Section 802: Criminal Penalties for Altering or Destroying Records, The sarbanes-oxley act select all that apply

Imposes severe penalties for knowingly altering or destroying financial records with the intent to impede investigations.

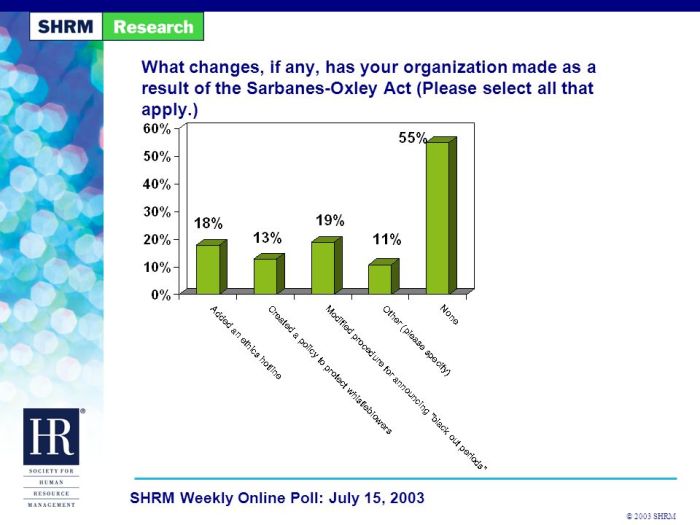

Impact of the Sarbanes-Oxley Act on Corporate Governance

SOX significantly strengthened corporate governance practices by:

- Increasing the independence of audit committees.

- Enhancing the role of boards of directors in overseeing financial reporting.

- Establishing new ethical standards for senior executives.

Criticisms and Controversies Surrounding the Sarbanes-Oxley Act

Increased Compliance Costs and Administrative Burdens

Critics argue that SOX has imposed excessive compliance costs and administrative burdens on businesses, especially small and medium-sized enterprises.

Unintended Consequences

Some critics contend that the Act has led to unintended consequences, such as a decline in innovation and risk-taking by companies.

Effectiveness in Preventing Corporate Fraud

While SOX is credited with enhancing corporate governance, its effectiveness in preventing corporate fraud remains a subject of debate.

Current State and Future Implications of the Sarbanes-Oxley Act

SOX remains a cornerstone of corporate governance regulation in the United States.

Ongoing debates and proposals for amendments or revisions focus on:

- Streamlining compliance requirements.

- Tailoring the Act to different company sizes and industries.

- Enhancing the focus on cybersecurity.

FAQ Compilation: The Sarbanes-oxley Act Select All That Apply

What is the Sarbanes-Oxley Act?

The Sarbanes-Oxley Act is a federal law that was enacted in 2002 to address corporate fraud and accounting scandals. It aims to enhance corporate governance, financial reporting, and auditing practices.

What are the key provisions of the Sarbanes-Oxley Act?

The Sarbanes-Oxley Act includes provisions related to corporate governance, financial reporting, and auditing. Key provisions include the establishment of the Public Company Accounting Oversight Board (PCAOB), enhanced financial disclosure requirements, and increased penalties for corporate fraud.

What impact has the Sarbanes-Oxley Act had on corporate governance?

The Sarbanes-Oxley Act has had a significant impact on corporate governance. It has strengthened the role of independent directors, increased the accountability of top executives, and improved the transparency and accuracy of financial reporting.