Mergers and inquisitions 400 questions pdf – Unveiling the intricacies of mergers and inquisitions, this comprehensive guide delves into the depths of these complex processes, providing an unparalleled resource for professionals and students alike. This document, meticulously compiled as a 400-question PDF, empowers readers with a thorough understanding of the history, types, benefits, risks, and ethical considerations surrounding mergers and inquisitions.

Throughout this guide, we will explore the various forms of mergers and inquisitions, examining their historical impact and current trends. By delving into case studies of both successful and unsuccessful mergers and inquisitions, we will gain valuable insights into the factors that contribute to their outcomes.

1. Overview of Mergers and Inquisitions

Mergers and inquisitions are two distinct processes that have significantly shaped the course of history. A merger is a combination of two or more entities into a single entity, typically with the aim of increasing efficiency, market share, or profitability.

An inquisition is an official inquiry, often conducted by a religious or political authority, to investigate and prosecute individuals or groups suspected of heresy, dissent, or other offenses.

Notable mergers throughout history include the Standard Oil merger in 1870, which created the world’s first oil monopoly, and the Daimler-Benz merger in 1926, which formed one of the largest automobile manufacturers in the world. Inquisitions have also played a significant role in history, with the Spanish Inquisition being one of the most infamous examples.

2. Types of Mergers and Inquisitions: Mergers And Inquisitions 400 Questions Pdf

Types of Mergers, Mergers and inquisitions 400 questions pdf

- Horizontal merger: A merger between two or more companies operating in the same market and at the same stage of production.

- Vertical merger: A merger between two or more companies operating at different stages of the production process for the same product or service.

- Conglomerate merger: A merger between two or more companies operating in unrelated markets.

Types of Inquisitions

- Ecclesiastical inquisition: An inquisition conducted by a religious authority, typically to investigate and prosecute heresy or other religious offenses.

- Political inquisition: An inquisition conducted by a political authority, typically to investigate and prosecute dissent or other political offenses.

- Secular inquisition: An inquisition conducted by a non-religious authority, typically to investigate and prosecute crimes or other offenses.

3. Processes and Procedures

Mergers

- Negotiation: The parties involved negotiate the terms of the merger, including the exchange ratio, the structure of the combined entity, and the management team.

- Due diligence: The parties conduct due diligence to assess the financial, legal, and operational risks associated with the merger.

- Regulatory approval: The merger must be approved by relevant regulatory authorities, such as antitrust agencies and securities regulators.

- Integration: The parties integrate their operations, systems, and cultures to create a single, cohesive entity.

Inquisitions

- Investigation: The inquisition investigates the alleged offenses, typically through interrogations, torture, and other methods of coercion.

- Trial: The accused are tried before a tribunal, which determines their guilt or innocence.

- Punishment: Those found guilty are punished, typically through imprisonment, torture, or execution.

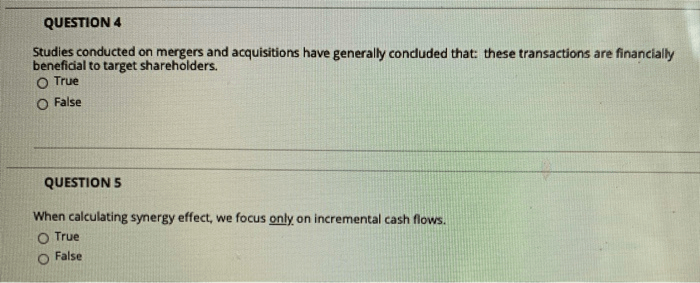

Questions Often Asked

What is the difference between a merger and an acquisition?

A merger is a combination of two or more companies into a single entity, while an acquisition is the purchase of one company by another.

What are the different types of mergers?

There are three main types of mergers: horizontal, vertical, and conglomerate.

What are the benefits of a merger?

Mergers can offer a number of benefits, including increased market share, reduced costs, and improved efficiency.

What are the risks of a merger?

Mergers can also pose a number of risks, including antitrust concerns, cultural clashes, and integration challenges.